WISE PLATFORM FOR BANKS & FINTECHS

Transform your financial institution's correspondent service when you start sending and receiving international payments with Wise Platform.

Use Platform to level up your existing infrastructure or create a world-class global payments experience.

<20 second

payments

62% of payments are instant - they arrive in under 20 seconds. 94% of payments take less than 24 hours.

65+ licences

worldwide

Our network is supported by 65+ licences, 90+ banking partners and 5 direct connections to payment systems.

£100bn+

annually

Around £30bn of the world's money moves through our infrastructure and across borders - every quarter.

Revolutionise your international payments with Wise Platform Correspondent Services

A smart solution that saves you time and money

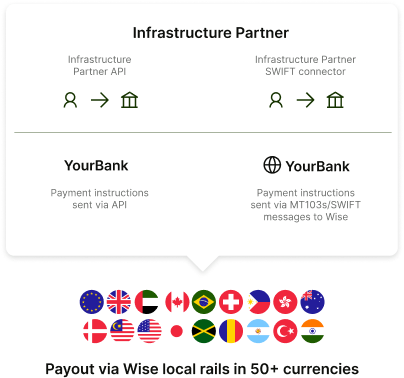

Rather than overhauling your tech, our solution enables banks to enhance international payments by simply redirecting Swift messages to Wise.

Wise Platform has built a portal which can receive payment instructions sent via MT or MX messages and translate them into a local payout executed on Wise’s network.

This results in lower costs, faster payment speeds and better transparency for your customers. It also gives them peace of mind to know what they’re paying, where their money is and how much will be delivered to the beneficiary.

Solutions purpose-built to your bank's needs

Wise Platform is configurable to suit every bank's global payments requirements, with both out-of-the-box and bespoke solutions readily available. Use Wise Platform to drop in a pre-built, end-to-end cross-border payments service for your customers, or integrate with us to improve your existing architecture for an easy, fast, and cost-effective way to modernise your payments infrastructure.

Wise Platform has a range of pre-built solutions ready to deploy, from developer-friendly end-to-end API connections to seamless integrations into Wise's payment platform.

- API Connected Payments Partner (Complete global payments solution)

- Infrastructure Payments Partner (White label payments processing solution)

- Affiliate Payments Partner (Referral program)

API connected

payments partner.

The power of Wise, embedded in your bank

Connected partners can access full-service integrations for global transfers, with drop-in components to suit your needs. Over 30 components are available to build your perfect payments engine.

Infrastructure payments partner

The smart alternative to correspondent banking

Connect your existing payments engine or rails including Swift to the Wise Payments Network to process customer transfers quicker, faster and at lower cost.

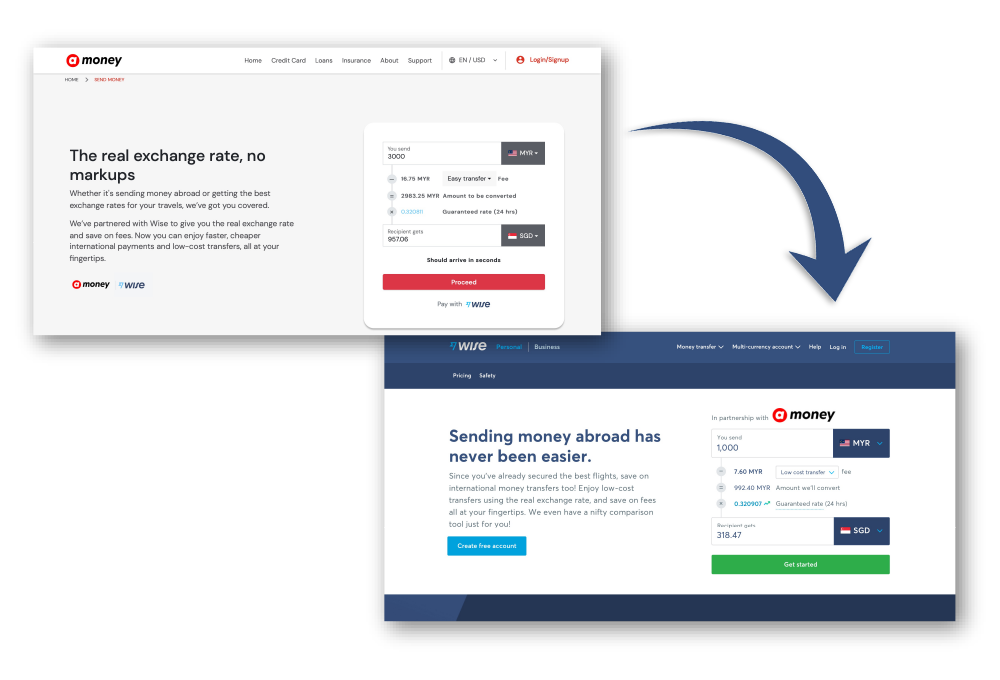

Affiliate payments partner.

International transfers, outsourced

Refer customers to Wise and generate new revenue in a quick and free Affiliate partnership solution. Offer international transfers to your customers and leverage Wise to manage your customers and do the heavy lifting.

Solution overview

Read all about our Send, Receive, Treasury & Spend capabilities for banks now by downloading our solution overview for banks.

Receive a

customised report

Want to know how many of your bank’s customers are using Wise?

Wise offers banks like yours a free, customised quarterly report with insights on how many of your customers are using Wise for their FX transfers, from where and into what countries. We can also share transaction speeds, trends and the historical increase / decrease in volume + much more.